FintechZoom.com Russell 2000 and the U.S. Economy

If you’re watching small-cap stocks, FintechZoom.com Russell 2000 is the place to start. This index tracks 2,000 small U.S. companies and gives a solid snapshot of how they’re doing.

I think it’s one of the best ways to gauge the heartbeat of America’s smaller businesses. So, let’s break down FintechZoom.com Russell 2000 in more detail.

What Is the Russell 2000 Index?

The Russell 2000 Index keeps track of the outcomes for 2,000 small firms in America. It helps give insight into the results of small companies in the market. Usually, these companies’ fluctuations with the economy make the index more quickly affected by economic news than the S&P 500.

As small companies are included in the Russell 2000 index, it lets people see the real state of the economy. Economists examine it to check if some areas are growing and to see if there are any problems in the country’s economic activities. The index normally performs well when the economy is doing well. When business is slowing, the fall happens faster as well.

FintechZoom’s Role in Tracking the Index

FintechZoom is an important tool for investors to analyze the way the Russell 2000 Index performs. There are daily updates, expert recommendations, and easy-to-follow charts about what is happening in small-cap stocks. If you wish to follow changes in an index or compare it, FintechZoom is an easy and simple resource.

A good way to succeed in the investing market is to inform yourself about opportunities. FintechZoom helps both beginners and experts to follow what’s happening in the market, identify hazards, and look for profitable opportunities.

No matter if the market goes up or down, the coverage of the Russell 2000 shows you how small businesses are responding to the economic conditions and what can happen to your portfolio.

6 Risks Involved With Small-Cap Investing

In the beginning of small-cap investing, I didn’t realize how quickly things could change. One day the stock is up, and the next it drops without warning. It taught me that while these stocks can grow fast, they also come with serious risks.

Higher Volatility

Small-cap stocks usually experience bigger highs and lows compared to other stocks. Prices of their shares can go up fast and just as easily come down again. For this reason, mid-cap companies are riskier than big companies when the market is unstable.

Not a Lot of Money Available

Many small companies tend to be short on cash and have fewer assets. This adds more difficulties for them when the economy slows down. Sometimes, smaller firms are not offered the same financial opportunities as larger companies.

Not as Many Areas Are Covered

Compared to large companies, small-cap companies usually get less coverage from the media and analysts. If investors do not do much research, it can be tougher for them to access accurate and recent information. As there is not enough evaluation, performance can drop or change unexpectedly.

Liquidity Issues

As these stocks are not actively traded much, buyers and sellers can experience difficulty in carrying out their transactions smoothly. When a lot of people try to sell all at the same time, the prices can suddenly drop. There is a chance that the losses will be greater than what is imagined.

Business Instability

Sometimes, businesses with smaller scales deal with larger difficulties. They can face troubles with running their business, facing competitors, or adapting to changes in what customers need. These problems can lower a company’s stock value in a short period.

Index Overlap Misunderstanding

Some investors confuse the Russell 2000 with bigger indexes like the Nasdaq, expecting similar results. But these indices track different types of companies and behave differently. It’s important to know what kind of businesses each index covers.

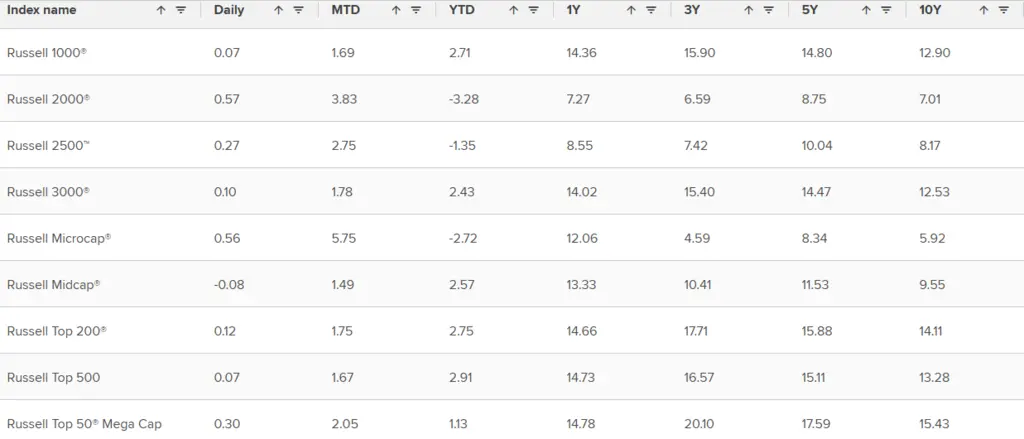

Recent Performance of FintechZoom.com Russell 2000

The start to 2025 was not good for the Russell 2000 Index. At the beginning of the year, the drop for this index was 9.5%, which made it even worse than the Russell 1000. Many small-cap stocks faced difficulties due to interest rate increases and general uncertainty. As investors were taking money out of risky stocks, small companies suffered more damage than the big ones.

By June, things started to look better. Analysts pointed to the annual index rebalancing as a possible reason for a short-term rally. The index began gaining strength, showing better weekly returns compared to earlier months. This momentum brought back some optimism in the small-cap space, especially with easing global trade tensions.

FintechZoom has helped investors follow these trends closely. For anyone watching small-cap stocks, stay hooked on Fintechzoom to keep your life easier with market updates.

Interested to Move Forward with Russell 2000?

Russell 2000 gives a clear look at how small businesses in the U.S. are doing. Meanwhile, FintechZoom is your go-to platform to easily follow this index with real-time updates and simple tools. Even if the economy is growing or slowing down, the Russell 2000 isn’t that volatile.

That’s why it’s useful for spotting early market shifts. If you want to track small-cap trends and make smart moves in today’s investing world, FintechZoom is a great place to start.

FAQs

Yes, Russell 2000 companies with a low capitalization adjust fast to new economic developments. When the economy’s growth is low or high, these companies let us know right away. So, this index is used by specialists to anticipate big moves in the market.

Small companies listed on the Russell 2000 indeed tend to be more volatile than big companies found in the S&P 500. Life sciences companies can achieve fast growth, but they suffer rapid declines as well. This introduces more problems, but it can also lead to great gains.

The index updates in real-time during U.S. market hours. Major changes, like annual rebalancing, usually happen in June each year. FintechZoom explains these updates clearly.